The need for sound energy policy has never been more critical.

American energy leadership is vital, perhaps more than ever, for our own prosperity and security in uncertain times and for the world. A global energy crisis – driven by surging post-pandemic demand outstripping supply and exacerbated by Russia’s invasion of Ukraine – has shown that the world needs more natural gas and oil, not less.

America can and should lead the world out of this crisis. The U.S. is the world’s leading producer of natural gas and oil and, with the right policies from Washington, must champion a reliable path forward that directly addresses today’s energy challenges.

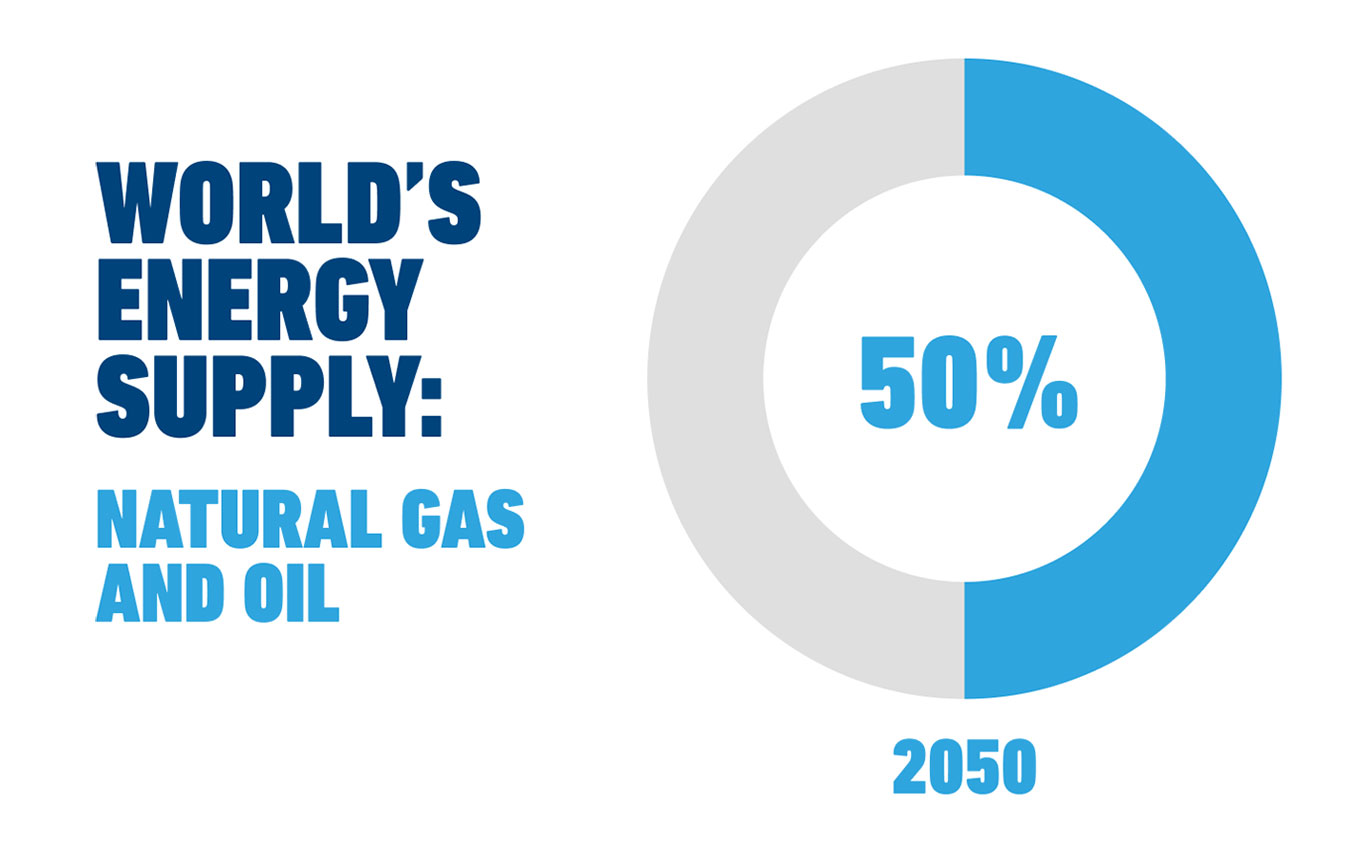

But first, there must be a course correction. Europe’s energy struggles show what can happen when countries lean too much, too soon on still-developing energy sources and energy from unstable regions while turning away from reliable natural gas and oil resources. Natural gas and oil are projected to provide nearly 50% of the world’s energy in 2050.

A more realistic energy approach is needed, where abundant American natural gas and oil is prioritized as a long-term strategic asset and a foundation for economic growth and strengthened energy security, today and tomorrow. Our energy resources also will provide opportunity, for decades to come, for other energy sources to mature and take on more significant roles.

In this new year, Washington should enact policies that fundamentally enable and promote investment in American natural gas and oil and support the vital refining sector. Though companies increased production this year to meet rising energy demand – and refineries operated near peak capacity to produce the fuels and products Americans use every day – more is required as populations and energy needs grow.

We need not return to growing dependence on foreign suppliers. Quite the opposite: American energy must lead in this space, through more domestic production and modernized infrastructure. If America doesn’t lead, others will.

We have the resources, yet sound energy policymaking is critically important. We invite members of Congress, the administration, and leaders across the country to join us in rolling up our sleeves to unleash American natural gas and oil. It starts with this simple realization: The solution is here.

All the best,

Mike Sommers,

API President and CEO

A Global Energy Crisis,

An American Solution

Three areas where well-reasoned policies can empower broad progress through American natural gas and oil.

Problem

Not Enough Energy to Meet Rising Demand

New oil production has fallen short of global demand, which reached near-record levels as economies recovered from the pandemic. As a result, countries including the U.S. used emergency releases from government-controlled oil reserves to counter the impacts of tight crude oil markets.

Washington should do more to foster investment in new U.S. oil and natural gas development and strengthen U.S. refining. It requires production that follows some of the highest environmental standards in the world to deliver long-lasting economic and security benefits – reliable energy, high-paying skilled jobs, more investment in America, stronger communities and a lower trade imbalance. However, through the Biden administration’s first 19 months in office, the U.S. Interior Department (DOI) leased fewer acres for drilling on federal lands and waters than any other administration in its first 19 months since the end of World War II, when the U.S. economy was a tiny fraction of what it is today. Producers need policy certainty, yet DOI’s proposed five-year offshore leasing program includes an option to hold zero lease sales. Onshore, the administration did not hold any quarterly lease sales in 2021, as required by law. In 2022, just one quarterly sale was held. Increased access to resources on public lands also is needed to develop more energy for use across America and to help allies abroad.

OIL AND NATURAL GAS LEASING: ADMINISTRATION PLAYING CATCH-UP

Since the end of World War II, no presidential administration over its first 19 months in office leased as few acres on federal lands and waters for oil and natural gas production as the Biden administration.

Solution

Increase Development of America’s Natural Gas and Oil

U.S. producers increased production in 2022, but more is needed. Crude oil production remained 1 million barrels below its record highs set in late 2019 and early 2020, primarily because of government policies, workforce and supply chain limitations, and a chilled investment landscape. Reasonable and smart energy policies are critical to supporting investment in long-lived natural gas and oil production, as well as billions of dollars in large capital projects supporting U.S. economic growth and strengthening U.S. energy security. Such policies decrease dependency on imported oil and enable U.S. manufacturing through the value chain by decreasing dependency on imported oil and also enabling U.S. manufacturing through the value chain. Petroleum demand is projected to grow over the next few decades, and without policies to help create a hospitable environment for investment in future projects, the U.S. will not meet demand and could once again become a significant importer of foreign energy.

According to a new Rystad Energy study, lifting development restrictions on federal lands and waters could add 395 million barrels of oil equivalent (boe) of production through 2035. This equals, on average, 77,000 boe/d from 2023-2035 and nearly $29 billion in investment in the U.S. economy. Energy development could also generate $4.8 billion in government royalties, taxes and lease bid revenues from 2023-2035.

Petroleum Production Must Keep Pace With Demand

U.S. petroleum use is projected by the U.S. Energy Information Administration to grow through 2050 (dark blue line). This could create a supply shortfall of nearly 2 million barrels per day by 2050 if U.S. production does not increase significantly over 2022 production (light blue line).

Specific policies and actions supporting increased American natural gas and oil production:

Issue Strong Leasing Program To Support Critical Development

DOI must issue a robust, final, five-year offshore leasing program for oil and natural gas that includes multiple leasing opportunities. Federal offshore activity provides more than 15% of total U.S. oil production.

Hold Quarterly Lease Sales as Required by Law

DOI should hold quarterly onshore lease sales, as required by law, with equitable terms. DOI should reinstate canceled sales and valid leases on federal lands and waters. Federal onshore activity provides 10% of U.S. oil production.

Allow Continued Use Of Safe HF Alkylation Units

Future federal rules should continue to allow U.S. refineries to use existing critical process technologies. Specifically, the Environmental Protection Agency should not require refineries to shift away from hydrofluoric acid (HF) alkylate, which has proven to be safe, efficient and reduce emissions. Currently, 88% of refining capacity in the U.S. is at refineries with alkylation units, with about 50% of them using HF as their primary catalyst. Replacing all U.S. HF alkylation units would cost between $12 billion and $19 billion and would likely lead to refinery closures and accompanying pressure on production.

HELP UNLOCK ACCESS TO CAPITAL

The federal government should clearly demonstrate support for natural gas and oil development in America now and in the long term. The U.S. Securities and Exchange Commission should reconsider its climate disclosure proposal, which is duplicative, costly and risks inconsistency in greenhouse gas reporting. This will help boost investor confidence in future development.

Problem

Lack of Energy Infrastructure to Meet Growing Demand

America lacks sufficient infrastructure for the future – including new natural gas and oil pipelines and investment in maintaining existing infrastructure – to move energy from production areas to refineries and processing facilities and then to places where it is needed by American families and businesses. Additionally, export infrastructure is needed so that America can aid allies abroad and project leadership in global markets, while also supporting domestic production and economic benefits.

Modernizing and expanding our nation’s energy infrastructure will require an efficient permitting system that supports timely and informed decisions based on merit and applied consistently. Unfortunately, permitting and review delays are blocking needed infrastructure. Ten major infrastructure projects, reflecting $34 billion in capital expenditures, were canceled, stalled or were at risk of cancellation due to permitting and review delays in recent years. For liquefied natural gas (LNG), permits to export natural gas to countries with which the U.S. does not have a free trade agreement (non-FTA) take five to 25 times longer to be approved by the Department of Energy than permits to export natural gas to FTA nations. Noteworthy: 20.9 billion cubic feet per day (bcf/d) of non-FTA export permit applications await government approval.

Project Cancellations, Delays Impact Access to Energy

Protracted and uncertain review processes have impacted 10 major natural gas and oil infrastructure projects, including four natural gas projects in Appalachia that could support 4.6 billion cubic feet per day of production needed by families and businesses in the region.

Delayed Liquefied Natural Gas Projects Impact U.S. Energy Leadership

Approvals for Non-Free Trade Agreement LNG Permits Can Take 25 Times Longer Than Free Trade Agreement Permits

Average number of days needed for approval, by application type and submission year.

Solution

Strengthen U.S. Energy Infrastructure, Including LNG Projects

Addressing the review and permitting process – which for some projects has dragged out 14 years – is critical for U.S. competitiveness, economic growth and energy security. Of the policy solutions presented in this report, 10 are included in API’s action plan, including solutions that would support $53 billion in new infrastructure investment over the next decade. In Appalachia alone, for example, infrastructure projects could have added 4.6 bcf/d of natural gas production. Regions such as New England would benefit from access to America’s abundant natural gas resources, and the U.S. infrastructure network would become more flexible and responsive – built to the highest professional and safety standards – and one of the safest ways to transport hydrocarbons. European LNG demand is expected to reach 19 bcf/d, and U.S. exports can grow to meet it – or other nations will meet that demand.

20.9 BCF/D IN U.S. LNG AWAITS FEDERAL PERMITS

Pending LNG Applications

U.S. LNG facilities must obtain a federal permit to send natural gas to nations with which the U.S. has a free trade agreement – and a separate finding to send natural gas to countries with which the U.S. does not have a free trade agreement, referred to as non-FTA nations. Below, 15 pending LNG permit applications as of Dec. 16, 2022, representing 20.9 billion cubic feet per day of natural gas.

Specific policies and actions supporting infrastructure development:

Reform Permitting And Review Processes

Congress should authorize major energy infrastructure projects as critical to the national interest, supporting energy production, processing and delivery. These reforms are necessary to establish interagency coordination, including the designation of a lead agency and strict timelines for environmental reviews. Additionally, there is a need to revamp the cross-border permitting process. Reforms need to apply to low-carbon energy infrastructure and should limit the application of the social cost of carbon to limited instances of direct impacts from project construction.

Make Environmental Reviews Uniform, With Established Time Limits

The National Environmental Policy Act (NEPA) affects many kinds of infrastructure projects – including wind farms, airports and traffic improvements – not just natural gas and oil. Under the current NEPA process, the average environmental impact statement takes four and a half years to complete, and 25% of completed impact statements took more than six years. NEPA reviews should be uniform across involved federal agencies and limited to two years. In addition, red tape associated with project applications should be reduced. In all, $157 billion in energy investment is waiting in the NEPA pipeline, and a two-year NEPA review time limit could spur $67 billion in energy investment.

Streamline The Review Process

Congress should amend the Natural Gas Act (NGA) to streamline the review process for all LNG projects to a single approval by the U.S. Energy Department (DOE). Pending LNG export project applications should be approved and accelerated by DOE. Supporting export demand while also meeting domestic energy needs could stimulate increased domestic production that could meet American demand, create jobs and generate U.S. economic growth.

HALT FERC OVERREACH OF PERMITTING AUTHORITY

The Federal Energy Regulatory Commission (FERC) should end the overstepping of its permitting authority granted by the NGA. FERC should adhere to traditional considerations of public needs while focusing on potential direct impacts from construction and operation of natural gas projects.

Rescind Steel Tariffs And Relieve Port Congestion

President Biden should rescind steel tariffs from the previous administration that affect $7 billion in annual steel imports and increase the accessibility of steel for energy production, transportation and refining. The administration also should speed up efforts to relieve port congestion to allow for the delivery and installation of equipment used for energy development. Energy companies spend $9.5 billion per year on steel for drilling and $4.8 billion per year on steel for pipelines.

Use Performance-Based Regulation To Help Advance New Technologies

Pipeline companies’ ability to maximize their investment in the latest safety-related technologies, emerging fuels and sustainable operations should be supported in congressional reauthorization of the Pipeline and Hazardous Materials Safety Administration (PHMSA). Regulations that are performance-based could give companies the flexibility to use advanced technologies and engineering practices – versus prescriptive regulatory language that might hinder innovation.

Problem

Deliver Affordable, Reliable Energy While Creating a Lower Carbon Future

The world’s need for more reliable, affordable energy is intertwined with the goal of ushering in a lower carbon future. Meeting energy demand – and alleviating energy poverty worldwide – with reliable, accessible energy while reducing greenhouse gas (GHG) emissions is the challenge of our time – and one the natural gas and oil sector is rising to address.

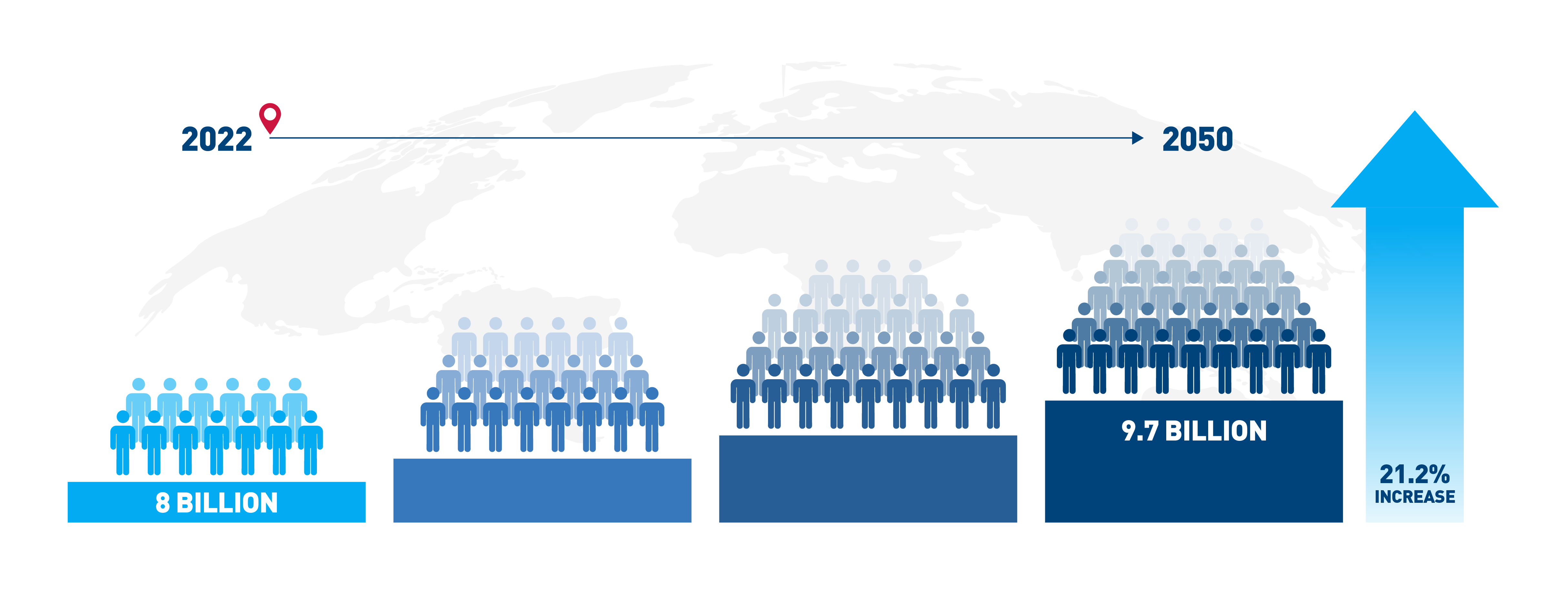

ENERGY AND A GROWING GLOBAL POPULATION

Even as energy production becomes more efficient and per-capita energy use may decline, the United Nations’ projection that the world will add nearly 2 billion people by 2050 means more energy will be needed around the globe.

Solution

Continue Innovating to Lower Carbon Emissions and Protect the Environment

American natural gas and oil companies are committed to innovation in lower carbon technologies, lower carbon energy development and cleaner products that are critical to modern economies and improving standards of living around the world – all critical to building a lower carbon future.

American producers are focused and achieving results in reducing our industry’s methane emissions. The Environmental Partnership, now five years old and representing more than 100 companies that account for 70% of the U.S. onshore natural gas and oil sector, has pioneered unprecedented collaboration and knowledge-sharing among participants. Members support specific actions to further reduce emissions of methane and volatile organic compounds – including a flare management program. Additionally, API’s Climate Action Framework details actions to meet the dual energy and climate challenge, including accelerating technological innovation and advancing cleaner fuels.

Companies are also leading in the deployment of carbon capture, utilization and storage (CCUS), which the Intergovernmental Panel on Climate Change says is central to reducing GHG emissions globally. And we’re poised to lead in producing hydrogen and cleaner transportation fuels, such as sustainable aviation fuel.

Increased Natural Gas Use Leads Reductions in U.S. Power Sector Emissions

U.S. power sector carbon dioxide emissions have declined since 2000, primarily because of increased use of natural gas to fuel electricity generation. Between 2006-2021, about 60% of power-related CO2 emissions reductions came from fuel switching to natural gas, with 40% coming from growth in zero-carbon generation, according to the U.S. Energy Information Administration.

Capturing Carbon from Industrial Processes

Carbon capture, utilization and storage technology reduces carbon dioxide from a range of energy-intensive sectors, not just natural gas and oil, shrinking the nation’s carbon footprint.

SPECIFIC POLICIES AND ACTIONS FROM POLICYMAKERS ARE NEEDED:

While the American energy supply chain has not waited on Washington to address energy and climate challenges, we urge government action to drive innovation.

Provide More Guidance To Further Reduce Emissions

Federal officials must develop additional guidance for Section 45Q tax credits that were expanded by Congress for the development of CCUS. This can help reduce the nation’s carbon footprint – not just from natural gas and oil, but also from a broad range of sectors, including energy-intensive industries like manufacturing, steel and cement-making. To maximize CCUS’ significant potential to reduce the country’s CO2 emissions, the Internal Revenue Service and U.S. Treasury Department should recognize the full extent of facilities for both direct air capture and industrial carbon capture that the law makes eligible for the 45Q tax credit. CCUS investment could total $77 billion from 2023-2035 while increasing CCUS capacity by 250 million tons per annum.

Value Each Ton in Carbon Dioxide Reductions Equally

Rules should allow a facility to claim the 45Q tax credit for carbon capture, transportation and storage activity, and the 45V tax credit for clean hydrogen production. In addition, the Section 45V tax credit for hydrogen – covering hydrogen made from all sources, including natural gas – should value equally each ton of carbon dioxide reduced. In this way, recent analysis shows more GHG emissions reductions and more hydrogen production can occur. Uniform policy incentives for hydrogen produced from natural gas with carbon capture and produced from electricity and other energy sources could avoid an additional 180 million metric tons of GHG emissions on average per year through 2050.

ESTABLISH CONSISTENT, TIMELY AND PREDICTABLE PERMITTING

A robust infrastructure system is needed to increase U.S. capacity to store carbon and fully capitalize on hydrogen energy. This includes carbon pipelines associated with CCUS for a variety of industry sectors in addition to natural gas and oil. Many of the permitting challenges for natural gas and oil infrastructure could impact development of low-carbon infrastructure. As with natural gas and oil, the permitting regime for low-carbon infrastructure should be consistent, timely and predictable to help encourage investment. Additionally, risk-based regulations that are efficient and effective are needed for regular operations.

Increase Funding for Work-Based Learning And STEM Programs

Our energy future will require a diverse, highly skilled workforce that uses innovative technologies to maximize performance in safely developing natural gas and oil, as well as low-carbon solutions. Skills in science, technology, engineering and math (STEM) are needed for many natural gas and oil careers. Congress and the Biden administration should support the training and education of a diverse workforce by increasing funding for work-based learning and advancement of STEM programs to nurture the skills necessary to construct and operate natural gas, oil and other energy infrastructure.